Dear Stake Holder:

Hedge Maker has been on auto-pilot test in managing equity portfolios in a sandbox for a few weeks. Demonstrated in the following, Hedge Maker outperforms the market.

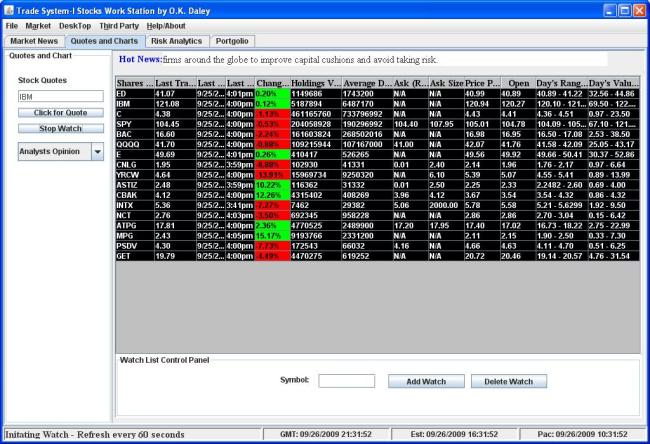

End of Day 2011/06/30 using Large Portfolios

End of Day 2011/06/29 using Large Portfolios

Start of Day 2011/06/27 using Large Portfolios

End of Day 2011/06/27 using Large Portfolios

Please note the difference in the percent column above.

Most of the portfolios have been trading for only a day.

Further note the percent market gain of the ones in green. Consider this compared to what the stock market normally averages for gains.

Compare the following charts: NAS Industry Index, and the other, Hedge Maker’s performance for its respective positions held. ( Charts are added weekly)

NASDAQ Industry Index 06/07/2011

Hedge Maker managed NASDAQ INDU Portfolio Performance 06/07/2011

I believe Hedge Maker’s performance in a downed economy is self evident when managing equity portfolios.

Hedge Maker’s NASDAQ Industry Portfolio Members

Continued History

NASDAQ Industry Index 06/16/2011

Hedge Maker managed NASDAQ INDU Portfolio Performance 06/16/2011

NASDAQ Industry Index 06/17/2011

Hedge Maker managed NASDAQ INDU Portfolio Performance 06/17/2011

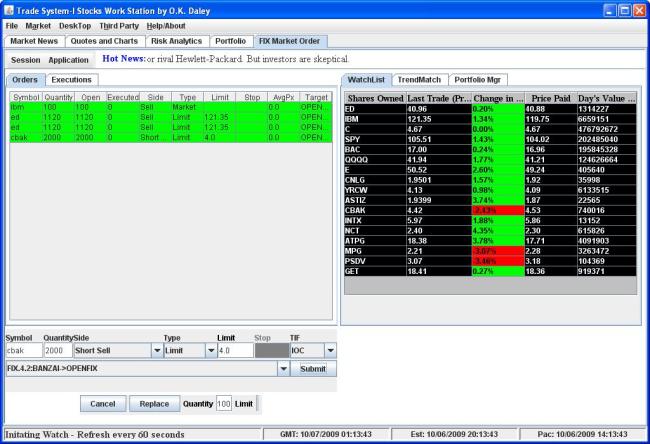

Equity Derivatives

Adding options and the Greeks is also a logical step forward like in the case of Goog in the third snapshot.

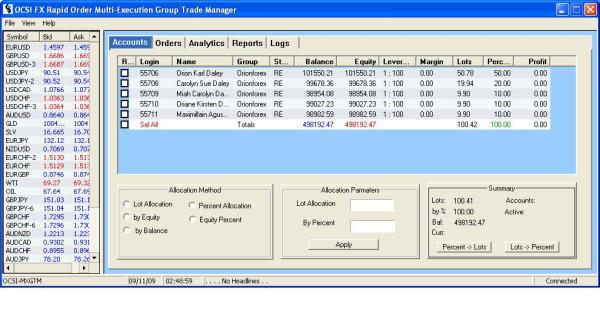

My business interest is:

A- To parallel test in my sand box, and later yours, against positions for demonstrating its worth.

Please send me a list of ( 20 ) twenty stocks for a Hedge Maker Portfolio, assuming a volume of 300-400 shares each, and I will show you my results in (20) twenty business days pro-bono.

B- To lease Hedge Maker based on monthly profits.

Based on profits only, I would like to be paid what you feel its worth to you!

Upon your inquiry, I would also like to send the white paper under NDA for your review.

Sincerely Yours,

Orion K. Daley

Recent Visitor Comments